Introduction

At MEG-Analytics, we pride ourselves on providing clean, efficient and intuitive solutions for our clients in the financial industry. We specialize in quantitative consulting, trading and risk-analytics software development and 3rd party vendor platforms like Front Arena. FA is a “batteries included” platform for risk analysis, position keeping and trading. It comes with tons of built-in functionality and it provides a great extension tool-set to plug any business logic, so that all the processes operate within the same framework. In this blog post, we will delve into the development of a simple, yet effective, tool that seamlessly imports tabular data into the FA database, to be further processed and displayed at a Trading Manager worksheet.

The Problem

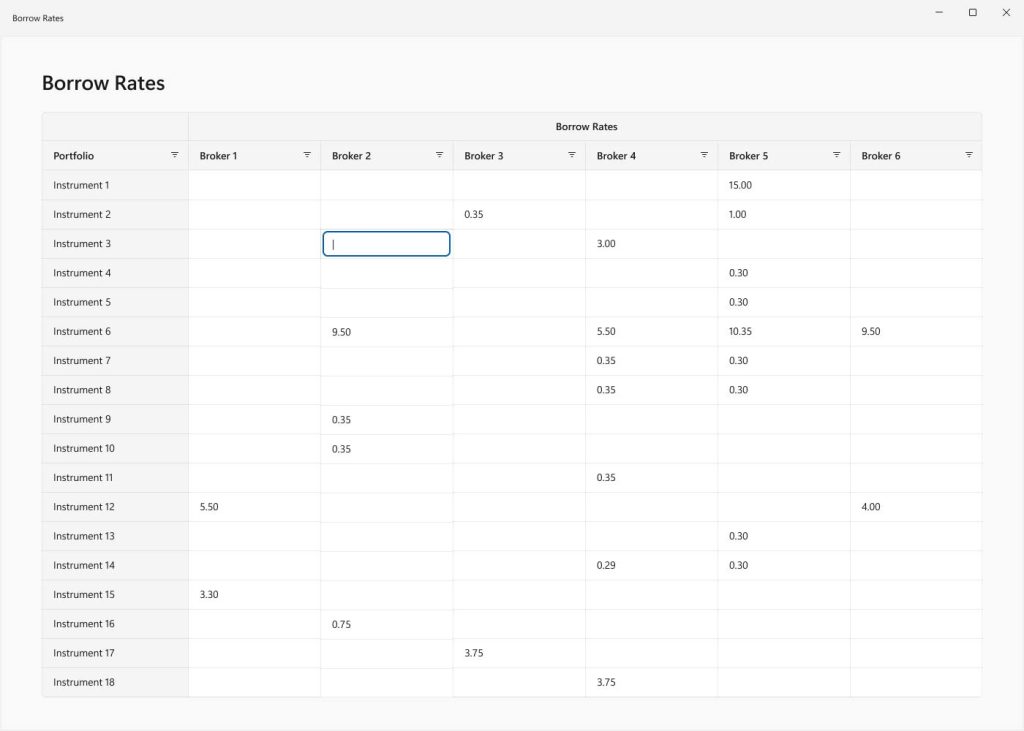

The problem was fairly simple. A client wanted to load historical data on demand as well as dynamically feed with live data from another system. In both cases, they wanted to be able to display the data at a Trading Manager worksheet. At the former, a trader can select the target date and load the data on the custom menu; at the latter the trick was to update the worksheet in real time, without having to reopen it. Albeit these are only a couple of user cases, the core tool can be used to load and display any custom tabular data into FA. The main issue was that FA does not support such functionality out of the box. The spreadsheet counterpart of FA, Trading Manager, is built so that the rows have to represent FA objects, such as instruments, portfolios and trades. Therefore, inserting raw data would need to bypass this requirement.

The Process

We started with developing a tool that reads the data from a json or an excel and dumps it as a json blob into the ADS database. After settling on the entities that will represent the column and row dimensions, we created the first GUI menu. Next, the client requested support for live update of the data, without having to re-open the application. The trick was to trigger a new valuation-tree calculation, including only the affected calculation pathways, leveraging this way the built-in valuation optimization of FA. More equivalent use cases followed and, organically, we generalized MTableImport to a flexible, extensible and modular tool. Finally, after employing the client’s feedback on the interface, we added some maintenance steps, to clean up unused objects after a data refresh and prevent any data duplications and inconsistencies.

Usage

The usage depends on the specifications of the underlying application, but the general idea is that inserting and displaying raw tabular data from an external source is one button click away.

Conclusion

At MEG-Analytics, we strive to support and empower our clients to overcome their most pressing challenges. We are excited to apply the best practices and witness the positive impact of our solutions. The development of MTableImport was just one example of that positive impact, that covered an existing gap of the framework and produced new data piping capabilities on top of FA.

To learn more about how we can support your organization, please contact us at k.polden@meg-analytics.com